New HMRC Advisory Fuel Rates: What They Mean for Drivers and Leaseholders

In a move that could impact thousands of company car drivers across the UK, HM Revenue and Customs (HMRC) has released its latest Advisory Fuel Rates (AFRs) update, effective from 1 June 2025. These rates are crucial for drivers and fleet managers alike, as they determine the amount employees can claim back per mile when using a company car for business purposes.

At Pendle Lease, we understand how vital it is to stay ahead of regulatory changes, especially those that affect your car leasing, vehicle leasing, and overall cost-efficiency. Whether you're managing a business lease fleet or navigating your personal lease, here's what you need to know about the new AFRs and how they could impact you.

What Are Advisory Fuel Rates (AFRs)?

AFRs are recommended reimbursement rates for fuel costs incurred when using a company car for work-related travel. Set quarterly by HMRC, they help businesses calculate what they can reimburse employees without triggering additional tax liabilities.

For example, if you use a petrol company car and drive 100 business miles, your employer can reimburse you at the AFR without it counting as a taxable benefit.

AFRs also apply if employees repay their employer for private mileage, such as personal use of a company car.

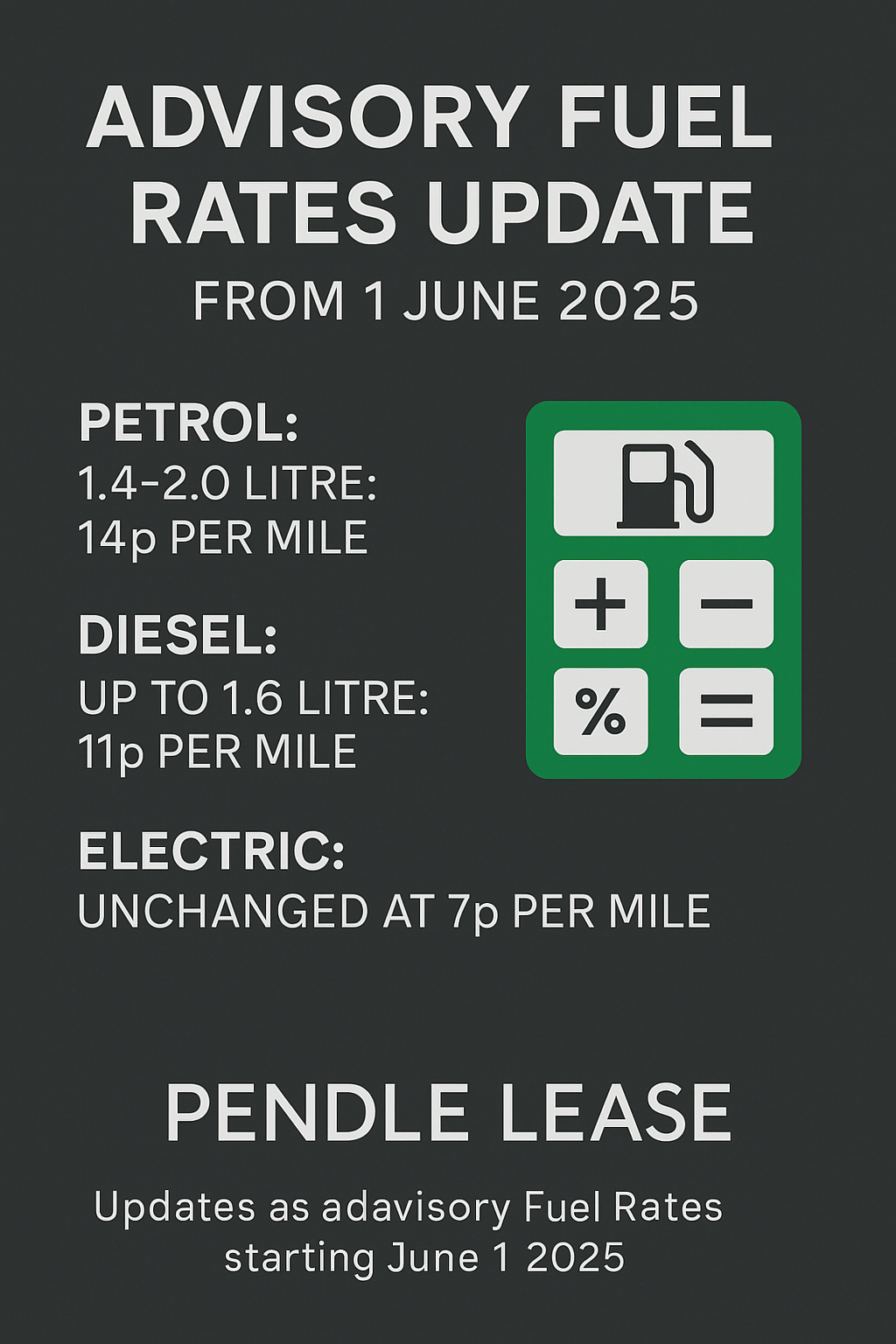

The New Rates: Effective from 1 June 2025

Here are the newly updated figures:

Petrol:

- Up to 1,400cc: 13p per mile (no change)

- 1,401cc to 2,000cc: 14p per mile (down from 15p)

- Over 2,000cc: 22p per mile (down from 23p)

Diesel:

- Up to 1,600cc: 11p per mile (down from 12p)

- 1,601cc to 2,000cc: 13p per mile (down from 14p)

- Over 2,000cc: 17p per mile (no change)

LPG:

- Up to 1,400cc: 10p per mile (no change)

- 1,401cc to 2,000cc: 12p per mile (down from 13p)

- Over 2,000cc: 18p per mile (down from 19p)

Fully Electric Vehicles:

- All engine sizes: 7p per mile (no change)

What This Means for Drivers

Reduced Reimbursements for Combustion Vehicles

The reduced AFRs mean company car drivers using petrol, diesel, or LPG vehicles may receive slightly less reimbursement for fuel costs. With fluctuating fuel prices and ongoing inflationary pressures, this change may not be welcome news.

However, this also reinforces a longer-term trend: HMRC is subtly encouraging the adoption of more efficient and eco-friendly vehicles.

Electric Cars Maintain Lower Running Costs

Notably, the rate for electric vehicles (EVs) remains unchanged at 7p per mile. While that may seem low compared to petrol or diesel rates, the actual cost per mile for EVs is often much lower than fossil-fuelled alternatives. For both businesses and individuals looking at vehicle leasing, EVs continue to be an attractive option.

The Leasing Angle: Smart Choices for Businesses and Consumers

At Pendle Lease, we’re seeing more businesses and individuals explore hybrid and electric options for their next lease. Why? Because these vehicles:

- Qualify for lower Benefit-in-Kind (BIK) tax rates

- Often enjoy lower maintenance and running costs

- Are aligned with government initiatives for sustainability

If you’re a fleet manager looking to reduce operating costs, or a personal lease customer weighing up fuel efficiency versus performance, the new AFRs offer a timely reminder to evaluate your next vehicle choice more strategically.

Business Lease Perspective: Operational Efficiency

For companies operating fleets, even a 1p difference in AFR can result in significant savings (or losses) over time. Imagine a fleet of 50 vehicles, each travelling 1,000 business miles per month:

- Under the old diesel rate (14p), that would be £700 per vehicle, or £35,000/month.

- Under the new diesel rate (13p), it becomes £650 per vehicle, or £32,500/month.

- That’s a £2,500/month saving just from an adjusted AFR.

While it benefits employers from a cost perspective, employees may feel the pinch if their real-world fuel expenses exceed the reimbursement.

Our advice at Pendle Lease? Use this opportunity to reassess your business lease portfolio. It may be time to switch some vehicles to electric or hybrid options that not only attract favourable AFRs but also align with broader ESG (Environmental, Social, Governance) goals.

Personal Lease Angle: Plug Into Savings

AFRs don’t apply directly to private leaseholders unless they’re being reimbursed by an employer for business mileage. However, the direction of travel is clear: low-emission and electric vehicles are becoming increasingly cost-effective to operate.

So if you're considering a personal lease, it's worth factoring in long-term fuel savings, as well as the increasing number of clean air zones and congestion charges that penalise high-emission vehicles.

As we always say at Pendle Lease: don’t just think about the monthly payment – think about the whole-life cost of the vehicle.

Key Takeaways

- Petrol and diesel AFRs have dropped by 1p in most bands

- Electric rates remain at 7p per mile, underlining their low cost-per-mile benefit

- Businesses can benefit from optimising fleets to align with lower AFRs

- Leasing an electric or hybrid vehicle continues to be a smart financial and environmental decision

Final Thoughts from Pendle Lease

Changes to AFRs may not grab headlines, but they matter. They influence reimbursement policies, driver satisfaction, and overall vehicle running costs. Whether you're managing a large company fleet or looking to make an informed choice on your next car lease, these updates deserve your attention.

At Pendle Lease, we help you make sense of it all. Whether it’s a plug-in hybrid for your sales team or an EV for your weekend getaways, we’ll find the right vehicle leasing deal for you.

Looking to make the switch? Talk to us today about how the latest AFR changes might affect your leasing strategy – and how we can help you stay one step ahead.